What's in store for investors in 2024?

2023-12-20 09:00

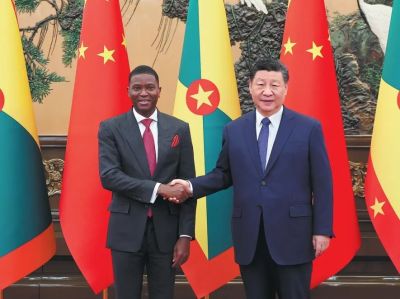

▲MA XUEJING/CHINA DAILY

Market mavens are quick to observe that over the past few years, geopolitical tensions have not only shaken many investors' confidence, but cast a long shadow over the global markets.

As 2023 draws to a close, heightened volatility characterizes stock markets, foreign exchanges, oil prices, among others. Consequently, investors have become increasingly risk-averse. This has pushed bullion prices to record highs over and over, they said.

The world may be still recovering from the COVID-19 impacts, but industry experts are wary of holding out promises of rosy prospects any time soon. Somewhat discouragingly to investors, some experts even said bluntly there may not be light at the end of the tunnel of political uncertainties in the near term. On the contrary, politics may well affect commodity markets in 2024, they said.

For instance, experts from UBS Global Wealth Management said politics will significantly influence investment in 2024. For one, the coming year will see US presidential election that many expect to be raucous and volatile. For another, protracted geopolitical conflicts and even outright wars appear possible.

Gold futures prices surged 5 percent one week after the Hamas-Israel conflict broke out on Oct 7. While some believed that such a spike spurred by market anxiety may be short-lived, both spot and futures prices of gold surpassed $2,150 per ounce on Dec 11 to hit new highs.

In late October, World Bank experts warned in a report that the conflict in the Middle East has heightened geopolitical risks for commodity markets, given existing uncertainties in the global environment.

But, it is not all doom and gloom. Overall, the market response at the moment appears relatively moderate. For example, in the oil markets, the conditions when the latest conflict broke out were notably different from the supply shocks seen in the past, said the WB experts.

But should the conflict escalate in the Middle East, a heartland for world's oil production, substantial oil supply disruptions are likely, if historical trends are any indication. A major escalation could cause an initial surge in oil prices, with disruptive knock-on effects on other commodity markets, they said.

Experts from the Asset and Wealth Management Investment Strategy Group at Goldman Sachs, an investment bank, estimated that the price of a barrel of oil is likely to trade between $70 and $100 for most of 2024. But they also said the price range does not preclude potential "sharp" price rallies or declines, with the heightened geopolitical risks one major trigger.

The only bright side, if at all, is that such drastic price fluctuations may be "transitory", they said.

Such potential oil supply disruptions could arise from factors like geopolitical tensions in the Middle East.

Apart from geopolitical risks, the likelihood of an economic recession from a global perspective, especially in the United States, and the US Federal Reserve's grip on US monetary policy, should not be overlooked when it comes to commodity markets' performance in 2024, experts said.

Agricultural products seem vulnerable. In an annual report, Rabobank, the Dutch bank specializing in comprehensive banking services for food and agricultural sectors, said that demand for farm products will remain low in 2024 due to economic problems, including high inflation and high interest rates, and will be further constrained by the slow development of the global economy.

After three years of record growth, geopolitical tensions, adverse weather and higher energy and natural resource costs, global food prices will decline in 2024, particularly those of staples like sugar, coffee, corn and soybeans, reducing consumer spending, Rabobank predicted.

Meanwhile, the US recession odds are climbing, said Goldman Sachs, citing a ratio of 30 percent to 40 percent over the next 12 months. This will result in a slowdown in oil demand growth worldwide, taking into consideration the tighter financial conditions globally, GS experts said.

Any US recession would lead to an uneven performance of nonferrous metals in 2024, especially in the first half, said Li Suheng, senior researcher at CITIC Futures.

But as the Fed is seen softening its aggressive monetary tightening in the second half of 2024, the US and Chinese monetary policies may gradually follow the same direction. Therefore, opportunities may still lurk among various challenges for nonferrous metals, with tin, zinc and aluminum anticipated to be the three best performers, she said.

Analysts from Guangzhou Finance Holdings Futures Co Ltd said the Fed's tightening will result in higher financing costs in US dollars, thus suppressing aggregate social demand and triggering capital outflows from other countries. The global economy will be affected and demand for commodities, which is closely related to production, will shrink.

On the other hand, any easing in US monetary policy would help elevate the prices of equity assets and benefit commodities. The diverse nature of monetary policies in major developed economies in 2024, combined with China's economic recovery, may translate into rising demand in investment and consumption, thus driving up commodity prices, they said.

Meanwhile, supply of commodities may decline in 2024 given the trend of de-globalization, transformation in energy consumption and geopolitical tensions. Smaller supplies will provide extra upward momentum for commodity prices, they said.

But not everyone agrees. Experts from China International Capital Corporation Limited said the contracting demand and tightening liquidity, both of which are taking place worldwide, will continue to weigh on commodity prices in 2024.

Gold is a must-have for any investment portfolio next year, analysts said. Michele Barlow, head of investment strategy and research for asset manager State Street Global Advisors in Asia Pacific, said gold can help diversify investments. The past two years show gold outperformed bonds, fixed-income products and stocks, all of which took roller-coaster rides. Gold, therefore, can hedge against any conflict-related volatility, she said.

Ming Ming, chief economist of CITIC Securities, said: "Since the last rate hike in July 2023, the Fed has been constantly playing with the market by releasing hawkish signals, trying to correct the expectation of a premature start of interest rate cuts. The Fed's effective guidance on market expectations began to fail after the 10-year Treasury rate broke through 5 percent at the end of October and turned downward. Therefore, gold prices continued to usher in the positive impact of rising interest rate cut expectations."

Goldman Sachs is upbeat about the investment opportunities for commodities in the next 12 months although the overall risk appetite has been shrinking. GS experts said investors should "go long on commodities in 2024". Higher spot prices and commodities being a hedge against feared geopolitical supply disruptions justify bullish sentiment on commodities next year.

The Goldman Sachs Commodity Index is estimated to report a 21 percent 12-month total return, with the energy sector likely to surge by 31 percent in 2024, while industrial metals will rise by 17 percent, they said.

As for oil, volatility may be the keyword in 2024, said UBS experts, estimating oil prices may oscillate between $90 and $100 per barrel in the following 12 months. So, investors, they said, can trade in this range, which is relatively safe to seek continued extra profits.

Reporter: Shi Jing